When it comes to managing your finances, creating financial statements is a crucial step towards understanding your financial status. Many companies use Microsoft Excel to create their financial statements as it offers numerous features and benefits. In this article, we will discuss several examples of financial statements in Excel.

Contoh Laporan Keuangan Excel Terupdate 2021

Zahir Accounting is a software company that provides accounting solutions for small to medium enterprises. They offer an Excel template for creating financial statements, which can be easily customized to meet your specific needs.

Their template includes separate sheets for income statements, balance sheets, and cash flow statements, making it easy to organize your financial data. It also includes charts and graphs to visually represent your financial information.

Using this template can save you time and effort in creating financial statements from scratch. It is also user-friendly, even for those who are not proficient in Excel.

Laporan Keuangan Perusahaan Excel

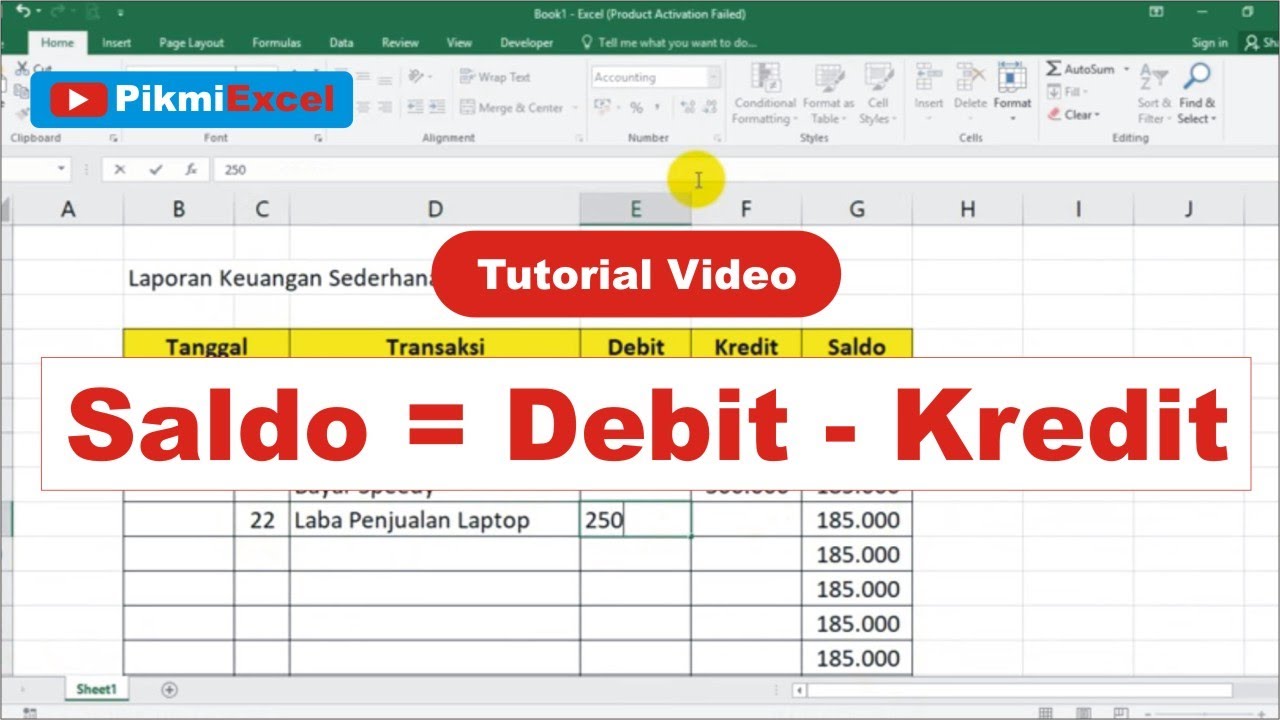

For those who prefer a video tutorial, Solution Gasw provides a step-by-step guide on how to create financial statements in Excel. In their video, they cover the income statement, balance sheet, and cash flow statement.

They also explain the importance of each statement and how they relate to one another in understanding a company’s financial status. The video tutorial is easy to follow, and they provide a downloadable Excel template for practice.

By following this tutorial, you will gain a deeper understanding of financial statements and how to create them in Excel. It is an excellent resource for beginners or those who need a refresher course in financial statements.

Contoh Laporan Keuangan Pemasukan Dan Pengeluaran Excel

Jurnal Siswa provides an excellent example of a financial statement that tracks both income and expenses. This template is useful for individuals who want to monitor their personal finances or small businesses that want to track their expenses.

The template tracks various sources of income, such as salary, rental income, and business income. It also keeps track of various expenses, such as rent, utilities, and transportation. The template calculates the net income or loss and provides a breakdown of your expenses.

This template is user-friendly and easily customizable, making it an excellent tool for managing your finances or a small business’s finances.

Cara Membuat Neraca Keuangan

Mama Baca provides a tutorial on how to create a balance sheet or Neraca Keuangan in Excel. A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time. It is essential in understanding a company’s financial position.

The tutorial is easy to follow and covers the basics of creating a balance sheet, such as identifying assets and liabilities. The tutorial also covers how to calculate equity and how to format the balance sheet for presentation.

By following this tutorial, you can create your balance sheet in Excel, giving you a better understanding of your financial status.

Format Laporan Keuangan Developer

Soal Kita provides an Excel template for financial statements specifically for developers. It tracks various sources of income, such as salary, royalties, and project income.

The template also tracks various expenses such as office rent, office expenses, and travel expenses. The template calculates the net income or loss and provides a breakdown of your expenses.

This template is useful for individuals in the development industry who want to track their income and expenses. It is easily customizable to meet your specific needs.

FAQ

What are financial statements and why are they important?

Financial statements are a set of reports that outline a company’s financial activities and performance. They include an income statement, balance sheet, and cash flow statement.

Financial statements are important because they help investors, creditors, and regulators assess a company’s financial status. They provide a snapshot of a company’s health at a specific point in time and serve as a guide on the best course of action to take in the future.

What are the benefits of using Excel for financial statements?

Excel offers numerous benefits for creating financial statements, such as:

- Flexibility: Excel allows for easy customization of templates to meet your specific needs.

- Accuracy: Excel’s built-in formulas ensure accurate calculations of financial data.

- Efficiency: Excel’s functions and shortcuts can save you time in creating financial statements.

- Analysis: Excel’s chart and graph functions can help visualize financial data for easier analysis.

Conclusion

The examples discussed in this article provide templates and tutorials for creating financial statements in Excel. These tools can aid in understanding your financial status and making informed decisions regarding your finances. Additionally, using Excel for financial statements offers numerous benefits, including flexibility, accuracy, efficiency, and analysis.

By utilizing these tools and understanding the importance of financial statements, you can take control of your finances and plan for a financially secure future.