Investment decision-making is one of the most crucial processes in the corporate world. It requires a thorough evaluation of the investment options with a focus on the financial metrics like net present value (NPV) and internal rate of return (IRR). These two metrics are critical in assessing the financial viability of an investment. In this article, we will delve deeper into the concept of NPV and IRR, their calculation, and how to interpret them in making investment decisions.

Net Present Value

NPV is a financial metric that measures the present value of future cash flows discounted by the cost of capital. Simply put, NPV measures the value added to the firm after accounting for the cost of capital. A positive NPV indicates that the investment will increase the company’s value, whereas a negative NPV will decrease it.

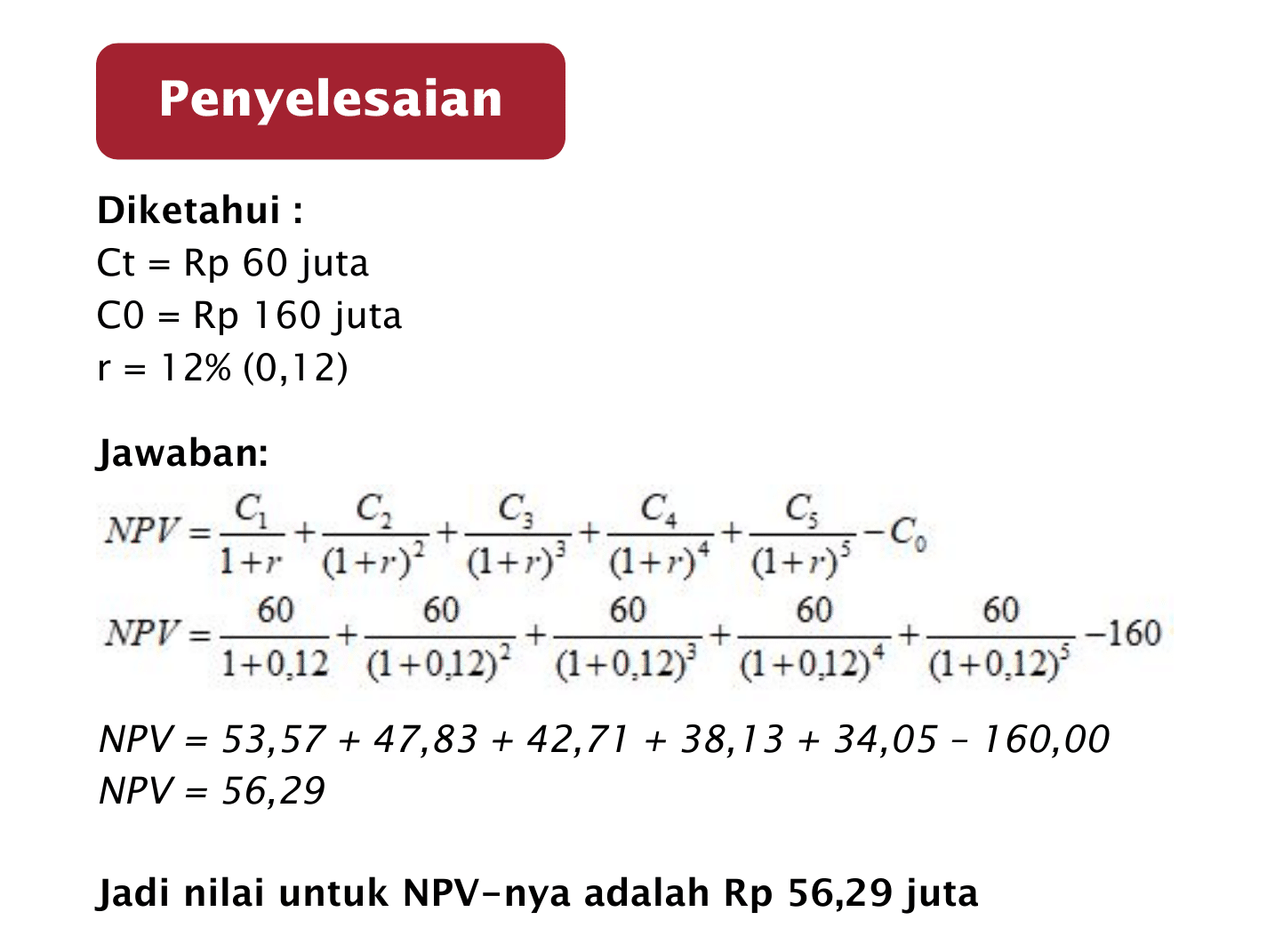

The formula to calculate NPV is:

NPV = CF0 + CF1 / (1+r) 1 + ... + CFn / (1+r) n

Where:

CF0: initial investmentCFn: cash flow in year nr: discount rate

The following is an example of a cash flow stream:

Let us assume that the cost of capital for the company is 10%. The NPV of this investment can be calculated as follows:

NPV = -50000 + 15000 / (1+0.10) 1 + 15000 / (1+0.10) 2 + 40000 / (1+0.10) 3

NPV = $9,860.91

A positive NPV suggests that the investment is financially viable, and the company should go ahead with it. Conversely, a negative NPV indicates that the investment is not worth pursuing, and the company should explore other options.

Internal Rate of Return

IRR is another essential financial metric used in investment decision-making. It measures the expected rate of return of an investment and compares it with the cost of capital. The IRR is the discount rate that makes the NPV of an investment equal to zero. In simple terms, if the IRR is higher than the cost of capital, the investment is considered financially viable. Otherwise, it is not.

The formula to calculate IRR involves solving for the discount rate that results in an NPV of zero. This can be done using mathematical techniques like trial and error or the Excel function IRR.

Let us take the same example of the cash flow stream and calculate its IRR. Using the Excel function IRR, we get an IRR of 18.98%. This indicates that the investment is financially viable as the IRR is higher than the cost of capital.

FAQs

What is the difference between NPV and IRR?

NPV and IRR are both financial metrics used in investment decision-making, but they differ in their approach. NPV measures the value added to the firm after accounting for the cost of capital, while IRR measures the expected rate of return of an investment and compares it with the cost of capital. NPV uses a discount rate to calculate the present value of future cash flows, whereas IRR calculates the discount rate that makes the NPV of an investment equal to zero.

What are the limitations of NPV and IRR?

NPV and IRR are useful metrics in assessing the financial viability of an investment, but they both have limitations. NPV assumes that the cash flow stream is predictable and stable, which may not always be the case, especially in dynamic markets. IRR assumes that the cash flows are reinvested at the same rate as the IRR, which may not always be possible. Additionally, IRR can give misleading results when cash flows change sign more than once. Therefore, it is essential to use these metrics judiciously and supplement them with other qualitative and quantitative measures.

Video Tutorial

Here is a video tutorial on how to calculate NPV and IRR using Excel: