As accounting professionals, we all know how important it is to have accurate and well-organized financial statements. But did you know that you can use Excel to streamline your accounting processes and create professional-looking reports? In this article, we’ll explore some of the best practices for using Excel in accounting, including formatting numbers, creating financial statements, and building custom applications.

Formatting Numbers

One of the most important aspects of accounting is ensuring that your numbers are consistent and easy to read. Excel offers a variety of ways to format numbers, including currency, accounting, and percentage formats. Here are a few tips for formatting numbers in Excel:

- Use the accounting format for currency values. This format aligns the dollar signs and decimal points so that your numbers are easier to read.

- Use the percentage format for percentages. This will automatically display the number as a percentage with a percent sign.

- Use the comma style for large numbers. This format inserts commas every three digits to make the number easier to read.

- Use conditional formatting to highlight important values. You can use conditional formatting to change the color or font of cells based on specific criteria.

Creating Financial Statements

Excel is a powerful tool for creating financial statements such as balance sheets, income statements, and cash flow statements. By using formulas and formatting tools, you can build professional-looking financial statements quickly and easily.

Balance Sheets

A balance sheet is a snapshot of a company’s financial position at a specific point in time. To create a balance sheet in Excel, you’ll need to create a list of the company’s assets, liabilities, and equity. Here’s an example of how to set up a balance sheet:

Once you’ve set up your balance sheet, you can use formulas to calculate totals and ratios. For example, you can use the formula “=SUM(B2:B5)” to calculate the total assets, and “=B7/B8” to calculate the debt-to-equity ratio.

Income Statements

An income statement shows a company’s revenues and expenses over a specific period of time. To create an income statement in Excel, you’ll need to create a list of the company’s revenues and expenses. Here’s an example of how to set up an income statement:

Once you’ve set up your income statement, you can use formulas to calculate net income and other important ratios. For example, you can use the formula “=SUM(B2:B5)” to calculate the total revenue, and “=B7/B6” to calculate the profit margin.

Cash Flow Statements

A cash flow statement shows a company’s cash inflows and outflows over a specific period of time. To create a cash flow statement in Excel, you’ll need to create a list of the company’s cash inflows and outflows. Here’s an example of how to set up a cash flow statement:

Once you’ve set up your cash flow statement, you can use formulas to calculate cash flow from operations, investing, and financing. For example, you can use the formula “=SUM(B2:B5)” to calculate the total cash inflows from operations, and “=SUM(B7:B9)” to calculate the net cash flow from financing.

Building Custom Applications

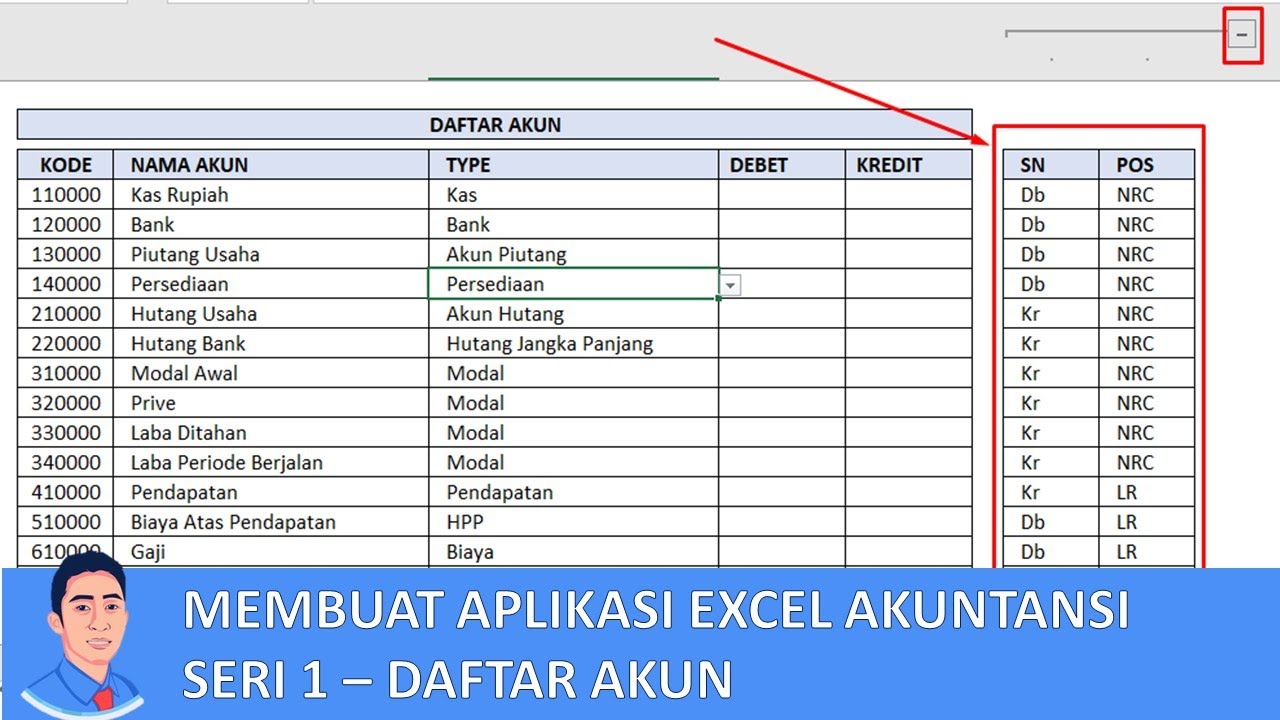

Excel’s flexibility and versatility make it a great tool for building custom accounting applications. By using macros and VBA (Visual Basic for Applications) code, you can create custom functionality that automates repetitive tasks and improves your productivity. Here are a few examples of how you can use macros and VBA to build custom accounting applications:

- Create a custom journal entry template. By creating a template that automatically populates accounts and amounts based on user input, you can reduce errors and improve efficiency.

- Create a custom report generator. By using VBA code to automate the process of generating reports, you can save time and reduce the risk of errors.

- Create a custom amortization schedule. By using macros to calculate loan payments and generate an amortization schedule, you can save time and improve accuracy.

FAQ

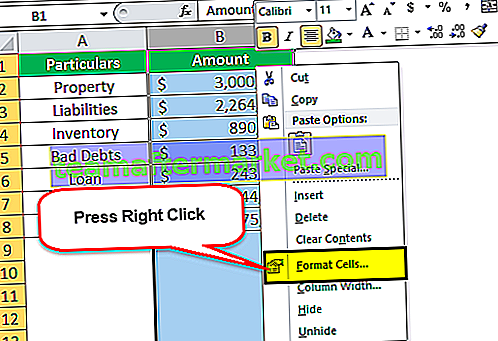

1. How can I quickly format numbers in Excel?

To quickly format a number in Excel, you can use the “Format Cells” dialog box. Simply select the cell or range of cells that you want to format, right-click, and choose “Format Cells”. From there, you can choose the desired format (such as currency, percentage, or accounting) and apply it to the selected cells.

2. How can I use Excel to create custom financial reports?

To create a custom financial report in Excel, you’ll need to start by setting up a data table that contains the relevant financial data. From there, you can use pivot tables and charts to summarize and visualize the data. By using conditional formatting and other formatting tools, you can create professional-looking reports that are easy to read and understand.

In conclusion, Excel is a powerful tool for accounting professionals. By using Excel to format numbers, create financial statements, and build custom applications, you can save time, reduce errors, and improve your productivity. Whether you’re a small business owner or a financial analyst, Excel can help you streamline your accounting processes and take your financial reporting to the next level.