If you’re running a business, one of the most essential things you need to do is to keep track of your finances. This means keeping track of your expenses, revenue, and profits. One way to do this is by creating financial reports. Financial reports are documents that summarize a company’s financial activities and present them in a format that is easy to understand. In this article, we will discuss how to create financial reports for your business and why it is important to do so.

Images for Financial Reports

An essential part of creating financial reports is using images to help present the information in a visual way. Here are some examples of images that can be used in financial reports:

Image One

This image is an example of a simple financial report for sales. It shows a chart that breaks down sales by month and highlights the highest selling month. This image can help readers quickly understand the company’s sales trends and performance over time.

Image Two

This image is an example of a report for inventory management. It highlights the slow-moving inventory and emphasizes the importance of managing inventory levels to ensure profitability.

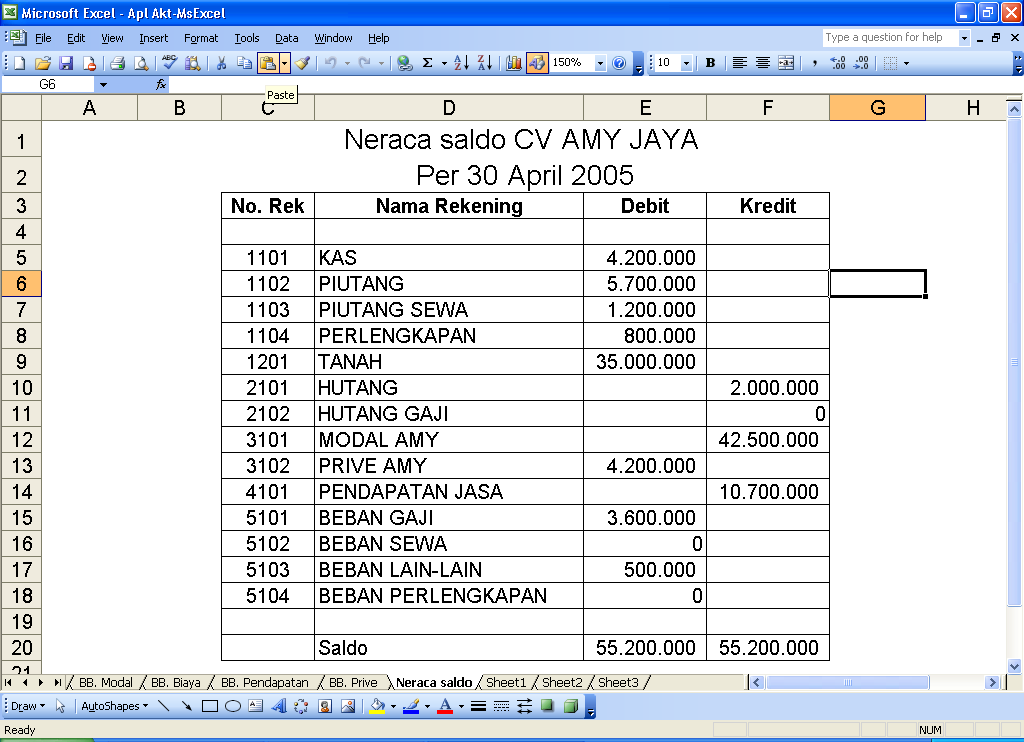

Image Three

This image is an example of a balance sheet or a statement of financial position, which shows a company’s assets, liabilities, and equity at a specific point in time. This image can be used to give readers an overview of the company’s financial health and solvency.

Image Four

This image is an example of a sales report for a specific product, in this case, HP laptops. It shows the sales for each month and the discounts given during that period. The report can help readers understand the pricing strategies used to increase sales and improve overall profitability.

Image Five

This image is an example of a sales report for multiple products. It shows the sales for each product and the total revenue generated during that period. This report can help readers understand which products are selling well and which products need improvement.

Why Create Financial Reports for Your Business?

Financial reports are an essential tool for businesses. Here are some reasons why you should create financial reports for your business:

1. Financial Reports Help You Track Your Business Performance

One of the most important reasons to create financial reports is to track your business’s performance. Financial reports can help you see how your business is doing financially and whether it is making a profit or not. It can also help you identify areas where you can cut costs or increase revenue to improve your bottom line.

2. Financial Reports Help You Make Decisions

Another reason to create financial reports is to help you make better business decisions. Financial reports can provide you with valuable insights into your business’s financial health, which can help you make decisions about which areas of your business to focus on, where to invest resources, and how to increase profitability.

FAQs

1. What should a financial report include?

A financial report should include the following components:

- Income statement, which shows revenue and expenses

- Balance sheet, which shows assets, liabilities, and equity

- Cash flow statement, which shows the flow of cash into and out of the business

2. How often should financial reports be created?

Financial reports should be created at least once a month to keep track of the business’s performance. However, the frequency of financial reporting may depend on the size of the business and its financial status.

Video: How to Create a Financial Report for Your Business

Overall, creating financial reports for your business is an essential task that can help you track performance, make better decisions, and improve profitability. Using the right images and presenting the information in a clear and concise manner can help make your financial reports more effective and easy to understand.